Application Features

Comprehensive Features of Our Accounting Softwarey

General Ledger

Accounts Payable

Accounts Receivable

Stock Management

Sales Management

Financial Reporting

Customization and Scalability

Security

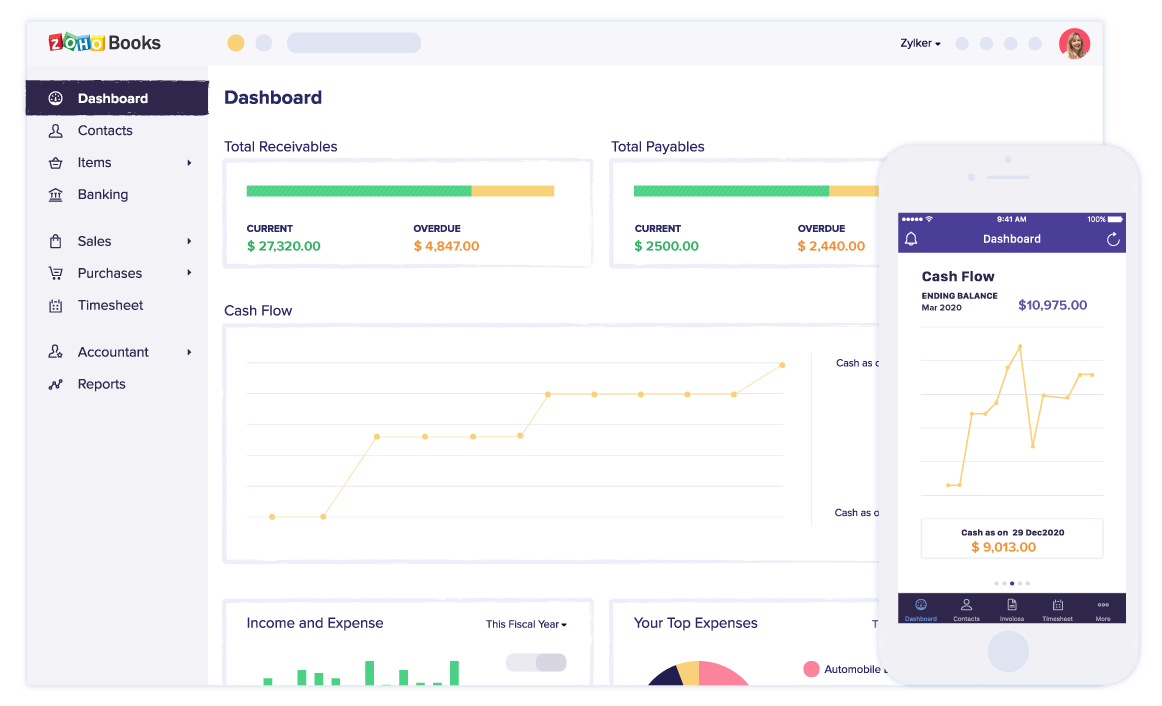

SALES AND ACCOUNTS RECEIVABLES

Sales and Accounts Receivables accounting software is designed to help businesses manage their sales processes, track receivables, and ensure efficient and accurate financial reporting. The software automates various tasks related to invoicing, payment tracking, customer account management, and financial analysis, enhancing productivity and accuracy while reducing manual workload.

INVENTORY AND STOCKS

Our accounting software provides a robust inventory and stock management module designed to optimize your inventory processes, reduce costs, and ensure you have the right products at the right time. This module integrates seamlessly with your overall financial management, delivering accurate and real-time insights into your inventory status.

GENERAL LEDGER

Open general ledger accounts, account classes and groups

• Record journal entries and budget entries

• Generate ledger accounts detailed inquiries with drill down reports

• Make journal inquiries with an option to view journal entries

• Closes the fiscal year and brings forward retained earnings

• Record depreciation entries on period based

• Make journal entries with corresponding entry in supplier / customer account

• Filter General Ledger reports by dimensions

• Quick entries (preset GL transactions) in bank deposit/payment, journal entry and supplier invoice/credit

REPORTS

• Print, Email and Convert into PDF; all the reports

• Export the reports in MS Excel/Open Office Calc format

• Generate reports on periodic and financial years basis

• Email documents directly to customers

• Make graphical analysis (Horizontal/Vertical Bars, Dot Lines, Pies and Donuts)

• Tag and save report selections. Accounting & Inventory Software Modules

SUPPORT & MAINTENANCE & TRAINING:

- Unlimited Support over phone, email or live chat

- Video Training: Free

- Training in Trust-IT-BD IT: Free

- Training at outside of Trust-IT-BD IT: 3000 Taka

- Please call: +8801978785522 or Email us: admin@Trustitbdltd.us

Accounting Software Security

- Strong Passwords: Use complex, unique passwords for your accounting software and change them regularly.

- Access Controls: Implement role-based access controls to limit who can view and modify sensitive data.

- Regular Updates: Keep your accounting software and operating system up-to-date with the latest security patches.

- Data Backups: Regularly back up your data to an external hard drive or cloud storage to protect against data loss.

- Security Software: Use antivirus and anti-malware software to protect your system from threats.

- Secure Network: Protect your network with a firewall and strong encryption.

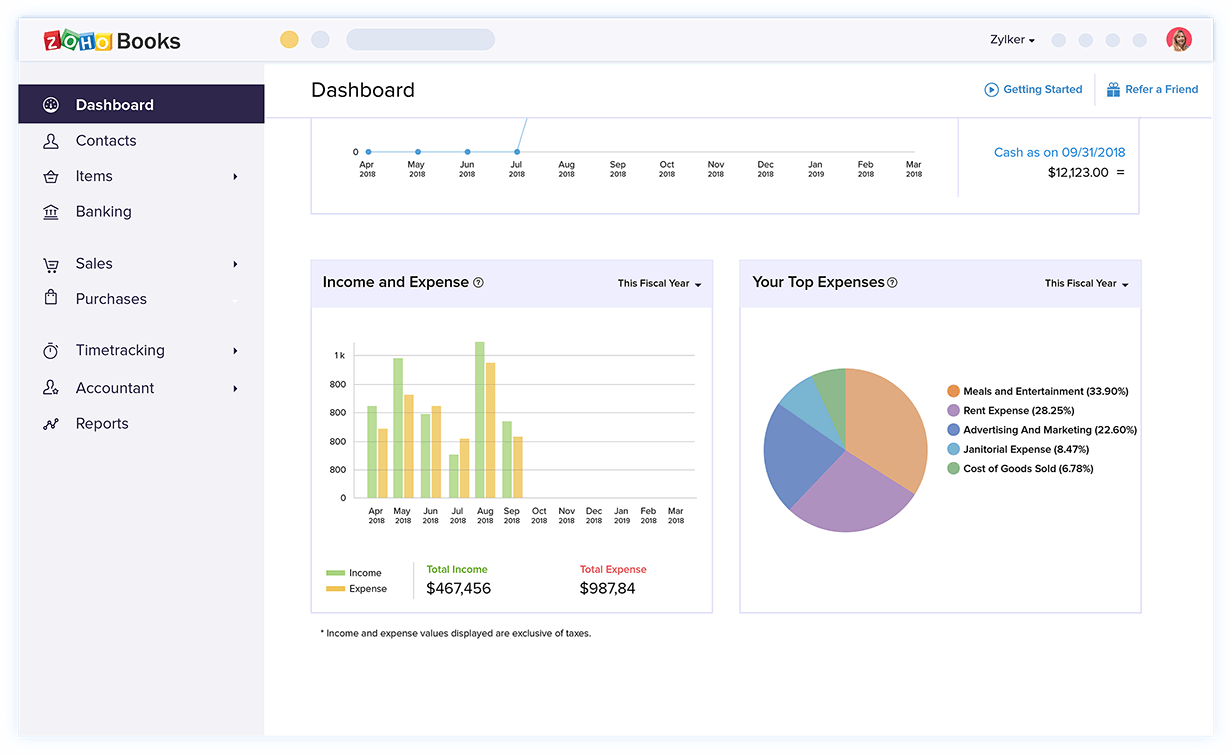

Key Features of Smart Account:

- Cloud-Based Accessibility: Access your financial data anytime, anywhere, from any device with an internet connection.

- Automated Data Entry: Streamline your accounting processes by automating data entry from various sources.

- Real-Time Reporting: Generate comprehensive financial reports instantly to make informed decisions.

- Inventory Management: Efficiently track inventory levels, manage stock, and optimize purchasing decisions.

- Payroll Management: Simplify payroll processing, calculate taxes, and ensure accurate employee compensation.

- Bank Reconciliation: Easily reconcile bank statements and identify discrepancies.

- Financial Forecasting: Analyze historical data to predict future financial performance and make strategic plans.

- Scalability: Grow with your business as Smart Account can adapt to changing needs.

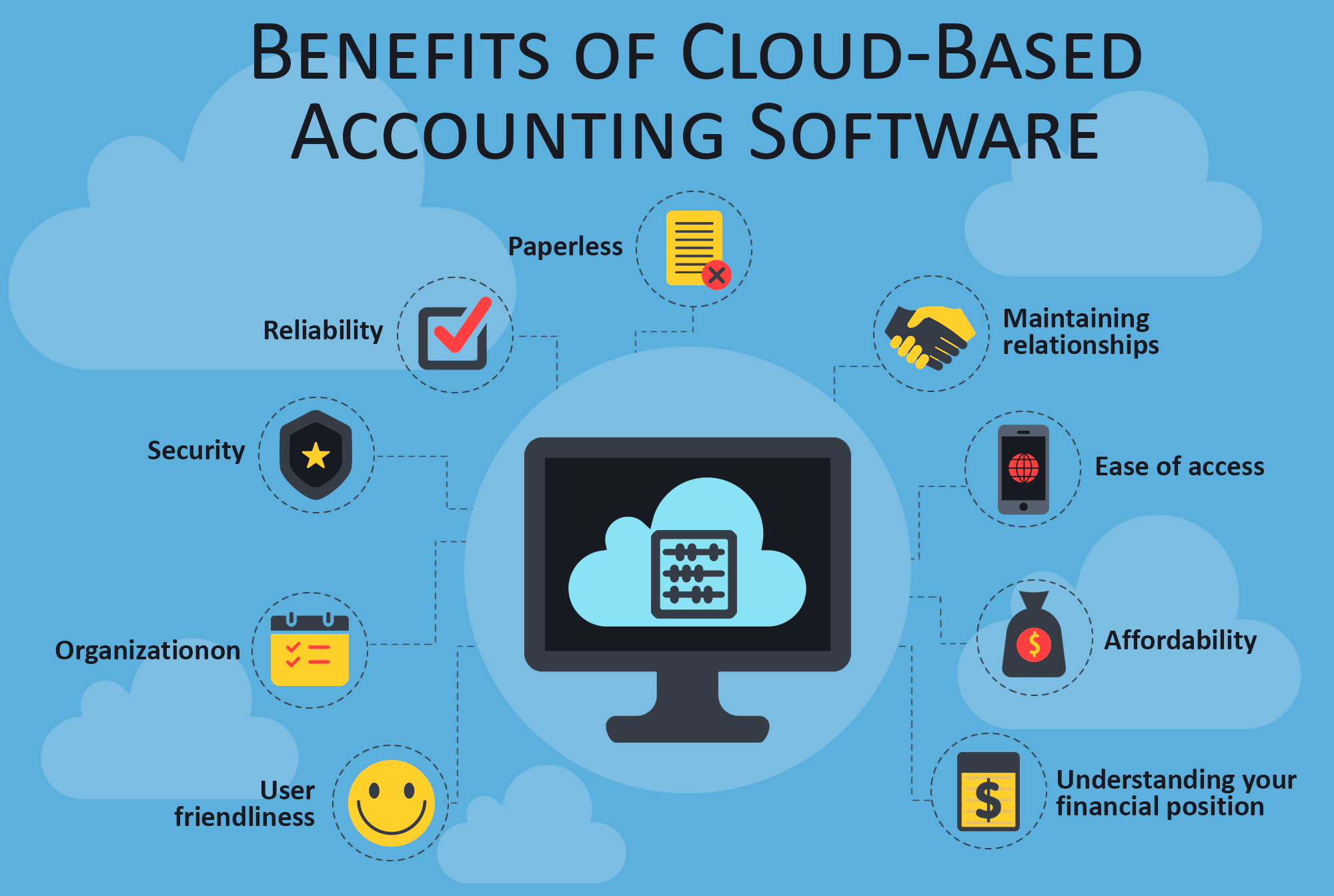

Benefits of Using Smart Account

- Increased Efficiency: Automate repetitive tasks, reduce manual errors, and save time.

- Improved Accuracy: Ensure accurate financial data through automated calculations and validations.

- Enhanced Decision Making: Access real-time financial insights to make informed business decisions.

- Better Cash Flow Management: Monitor cash inflows and outflows to optimize cash flow.

- Enhanced Customer Satisfaction: Improve customer service by efficiently managing customer information and sales.

- Compliance Adherence: Stay up-to-date with financial regulations and avoid penalties.

- Scalability: Grow your business without limitations as Smart Account adapts to your needs.

- Cost Savings: Reduce accounting costs by streamlining processes and eliminating manual tasks.

Why Choose Smart Account from Trust-IT-BD IT?

- Expert Support: Benefit from Trust-IT-BD IT’s dedicated support team available to assist you with any questions or issues.

- Customization: Tailor Smart Account to your specific business requirements with flexible customization options.

- Data Security: Rest assured that your sensitive financial data is protected with robust security measures.

- Regular Updates: Enjoy continuous improvement with regular software updates and new features.

- Competitive Pricing: Get excellent value for your money with affordable pricing plans.

- Customer Focus: Trust-IT-BD IT is committed to customer satisfaction and provides exceptional support.

Need Help?

Accounting Software FAQ

Accounting software is a computer application that helps businesses and individuals manage financial transactions, streamline bookkeeping, and generate financial reports. It typically includes features for invoicing, payroll, expense tracking, tax compliance, and bank reconciliation. Popular examples are QuickBooks, Xero, and Sage.

- Efficiency: Automates routine tasks, saving time and reducing manual errors.

- Accuracy: Enhances precision in financial records and calculations.

- Organization: Centralizes financial data for easy access and management.

- Compliance: Helps ensure adherence to tax laws and accounting standards.

- Reporting: Generates detailed financial reports for better decision-making.

- Scalability: Adapts to the growing needs of a business.

- General Ledger: Core financial data management.

- Invoicing: Create and track customer invoices.

- Expense Tracking: Record and categorize expenses.

- Payroll: Manage employee payments and tax withholdings.

- Financial Reporting: Generate balance sheets, income statements, etc.

- Tax Management: Ensure compliance and prepare tax returns.

- Bank Reconciliation: Match records with bank statements.

- User Access: Multi-user support and role-based permissions.

- Integration: Compatibility with other business tools.

- Scalability: Ability to grow with your business.

Yes, accounting software is highly suitable for small businesses. It automates financial tasks, reduces errors, and saves time, allowing small business owners to focus on growth.

Accounting software generally offers robust security features to protect financial data, including:

- Data Encryption: Secures data during transmission and storage.

- User Authentication: Requires strong passwords and multi-factor authentication.

- Access Controls: Restricts access based on user roles and permissions.

- Regular Backups: Ensures data is regularly backed up to prevent loss.

- Compliance: Adheres to industry standards and regulations for data protection.

Despite these measures, the overall security also depends on the user's practices, such as keeping software updated and using strong passwords.

Many accounting software solutions can handle multiple currencies. This feature allows businesses to:

- Transact in Various Currencies: Send and receive payments in different currencies.

- Automatic Currency Conversion: Convert amounts based on current exchange rates.

- Multi-Currency Reporting: Generate financial reports that consolidate and display data in a chosen base currency.

- Track Currency Gains and Losses: Monitor and account for fluctuations in exchange rates.

+8801774-631733

+8801774-631733 support@trustitbdltd.com

support@trustitbdltd.com